The Right Partner to Save Money Now.

Take 46 Seconds Discover how much is being wasted in your Business. Tell us a little bit about your company so we will show you.

FeeFighters Mission

We Bring Big Company Pricing for Small & Medium Companies. We Fight for Small & Medium Business Owners.

As Seen In

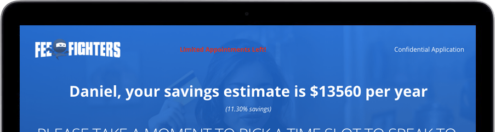

82% of companies find $12,000 wasted annually.

How much are you losing?

OUR CUSTOMERS ARE TALKING

Patrick M

Awesome Dad's Shirt

Before FeeFighters, we were getting crushed by fees. We found out we were paying a crippling 42% in fees.

We were losing money on each order, but all costs were in line except one, credit card fees.

The team at FeeFighters adjusted software and negotiated to get fees back in line. Within 2 months we had dropped to 7.9%. That's over $270k each year!

We’re lucky we found FeeFighters when we did.

Alan Klug

800-GOT-JUNK

We bought 800 Got-Junk Pittsburg a few years ago and inherited the previous owners payment company. We focused on fixing all of our other issues.

We sent a statement and had a 10 minute call.

A few days later I got a call that we had saved over $24k which was perfect timing since that helped us pay for new trucks and a bookkeeper.

Reduce Credit Card Processing Fees with FeeFighters

Our money-saving methods offer you the right strike to increase your marginal profits. Be Helped by a Money-Saving Ninja.

© 2019 – FeeFighters, LLC – Call Us – (646) 448-8804

PO BOX 1459, MOUNTAINSIDE, NJ 07092